florida estate tax exemption 2021

The estate tax exemption in 2021 is 11500000. This exemption is up from 159000 in 2021.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Assessed Value 85000 The first 25000 of value is exempt from all property tax the next 25000 of value is taxable the third.

. However if the current federal tax laws remain in place the exemption amount will be decreased by 50 in 2026. Proposal 2 Limitation on Lifetime Gifting. The exemption increases with inflation.

2022 Annual Exclusion Gift to non-US. 25000 of value is exempt from non-school taxes. Estate Tax Exemption for 2021 The estate tax exemption in 2021 is 11700000.

In 2021 the standard deduction increases to 12550 for individuals up from 12400 in 2020 and to 25100 for married couples up from 24800 in 2020. Income over 445850501600 married. 3 Oversee property tax.

Discover Florida Property Tax Exemptions For Seniors for getting more useful information about real estate apartment mortgages near you. What this means is that estates worth less than 117 million wont pay any federal estate taxes at all. Floridas capital gains tax rate depends upon your specific situation and defaults to federal rules.

Citizen Spouse - increased to 164000. 2 Enforce child support law on behalf of about 1025000 children with 126 billion collected in FY 0607. Presently the tax exemptions are set at 11700000 per person an increase from 2020s exemption of 11580000.

If youre a Florida resident and the total value of your estate is less than 114 million you will pay neither state nor federal estate taxes. However the new tax plan increased that exemption to 1118 million for tax year 2018 rising to 114 million for 2019 1158 million for 2020 117 million for 2021 and 1206 million in 2022. Even though Florida doesnt have an estate tax you might still owe the federal estate tax which kicks in at 117 million for 2021.

1 Administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually. The District of Columbia moved in the opposite direction lowering its estate tax exemption from 58 million to 4 million in 2021 but simultaneously dropping its bottom rate from 12 to 112 percent. 2021 Florida Sales Tax Commercial Rent December 30 2020.

House Read 2nd time Placed on 3rd reading Added to Third Reading Calendar. Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business. This means that when someone dies and.

Federal Estate Tax. Senate In Messages. House Read 3rd time Passed.

Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. Ncome up to 40400 single80800 married. If your estate is in the ballpark of the estate tax limits and you want to leave the maximum amount to your heirs youll want to do some estate tax planning.

Citizen may exempt this amount from estate taxation on assets in their taxable estate. Income over 40400 single80800 married. The amount of the estate tax exemption for 2022 For 2022 the personal federal estate tax exemption amount is 1206 million it was 117 million for 2021.

Every person who has legal or equitable title to real. This exemption is already set to be cut in half in December of 2025. 2022 Annual Gift Tax Exclusion - increased to 16000 from 15000.

Property in the State of Florida and who resides thereon. Thursday November 18 2021 Increases in Estate and Gift Tax Exemption Amounts Announced by IRS We have gone from scrambling to deal with a decrease in the unified credit under proposed legislation to now enjoying the 2022 inflation adjustments. For the 2021 tax year you need to file for the homestead exemption between March 3 2020 - March 1 2021.

You can also late file in some limited circumstances. If you miss these deadlines you cannot get the exemption for a prior year. YEAS 109 NAYS 3.

Starting in 2022 the exclusion amount will increase annually based on. Standard deductions also rise and as a reminder personal exemptions have been eliminated through tax year 2025. The exemption amount varies as each town votes on the amount.

Application by March 1 of the tax year shall constitute a waiver of the exemption privilege for that year. Jabil was the second and received a 100000 exemption per year for five years in August. Exemption for Totally and Permanently Disabled Persons Income Limitation Any real estate used and owned as a homestead less any portion thereof used for commercial purposes by a paraplegic hemiplegic or other totally and permanently disabled person as defined in Section 1961014 FS who must use a wheelchair for mobility or who is legally blind shall be exempt.

Individuals and families must pay the following capital gains taxes. House Bill referred to House Calendar Added to Second Reading Calendar Bill added to Special Order Calendar 4222021 4222021. The estate tax exclusion is 4000000 as of 2021 after the district chose to lower it from 5762400 in 2020.

An individuals leftover estate tax exemption may be transferred to the surviving spouse after the first spouses death. Still individuals living in Florida are subject to the Federal gift tax rules. The added 25000 applies to assessed value over The top tax rate is 16.

Federal exemption for deaths on or after January 1 2023. The late filing date for 2021 is September 20 2021. The current proposal is set to reduce the exemption to 3500000.

Beginning in 2019 the cap on the Connecticut state estate and gift tax is reduced from 20 million to 15 million which represents the tax due on a Connecticut estate of approximately 129 million. The first 25000 of value is exempt from all property tax thenext 25000 of value is taxable and 15000 of value is exempt from non-school taxes.

Florida Estate Tax Rules On Estate Inheritance Taxes

Florida Homestead Exemption Martindale Com

Eight Things You Need To Know About The Death Tax Before You Die

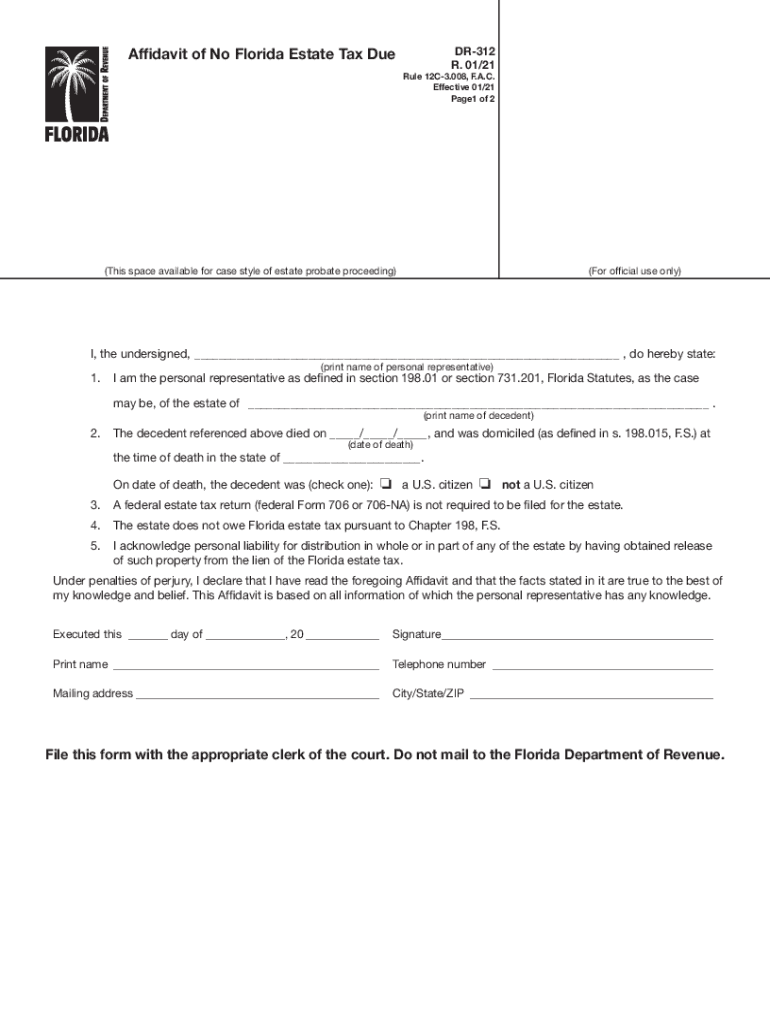

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

Estate Tax And Gift Tax Changes Coming In 2022 Karp Law Firm

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Florida Inheritance Tax Beginner S Guide Alper Law

Fl Dor Dr 312 2021 2022 Fill Out Tax Template Online Us Legal Forms

Estate Tax Landscape For 2021 And Beyond

How Is Tax Liability Calculated Common Tax Questions Answered

Estate Tax Planning And Using A B Trusts For High Net Worth Estates Estate Planning Attorney Gibbs Law Fort Myers Fl

States With An Inheritance Tax Recently Updated For 2020

![]()

Florida Inheritance Tax Beginner S Guide Alper Law

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

States With No Estate Tax Or Inheritance Tax Plan Where You Die